Starting Early Ensures Budget Success

Start your IT infrastructure budget planning 6 to 9 months before the fiscal year by conducting thorough audits, identifying critical gaps, and quantifying how infrastructure impacts business performance. This 2026 budget preparation timeline gives you adequate time to build compelling cases and secure necessary approvals.

Most organizations begin budget discussions too late, forcing rushed proposals that lack supporting data. Early preparation allows time for stakeholder alignment, vendor negotiations, and realistic cost modeling.

This guide covers seven essential strategies for infrastructure spending preparation that position your budget requests for approval success.

How Do You Audit Current Infrastructure Costs and Performance?

Baseline analysis through comprehensive infrastructure cost audit establishes current spending, utilization patterns, and performance issues that inform realistic budget requests. Without accurate baseline data, you’re guessing at requirements rather than planning strategically.

Start with complete cost inventory across all infrastructure categories. Document server costs, network expenses, storage spending, software licenses, support contracts, and cloud consumption. Include both capital and operational expenses to understand total spending.

Infrastructure audit components:

- Hardware and software asset inventory with purchase dates and depreciation

- Monthly cloud and SaaS spending by service and department

- Support contract costs and renewal dates

- Performance metrics showing utilization and bottlenecks

- Incident history revealing reliability issues

IT spending analysis should identify inefficiencies costing money without delivering value. Underutilized servers, redundant software licenses, and oversized cloud instances represent immediate cost reduction opportunities. Quantifying these inefficiencies strengthens your credibility when requesting new investments.

Performance metrics reveal where infrastructure limitations affect business operations. Slow application response times, frequent outages, and capacity constraints translate to lost productivity and revenue. Managed IT Services teams track these metrics continuously to inform infrastructure planning and demonstrate need for improvements.

What Infrastructure Gaps Will Impact Business Goals?

Technical limitations that prevent achieving business objectives require translation into executive language focusing on revenue impact, competitive positioning, and risk exposure. Infrastructure gaps analysis connects IT constraints to business outcomes leaders care about.

Capacity constraints limiting growth represent clear business impact. If your e-commerce platform can’t handle holiday traffic spikes or your data warehouse lacks capacity for analytics expansion, these technical limits directly restrict business strategy execution.

Business impacting infrastructure gaps:

- Insufficient capacity preventing geographic or product expansion

- Security vulnerabilities exposing customer data and regulatory compliance

- Technology obsolescence creating competitive disadvantages

- Integration limitations blocking digital transformation initiatives

- Disaster recovery gaps risking extended business interruption

Security vulnerabilities carry quantifiable risk. Calculate potential breach costs using industry averages for your sector and company size. A breach costing $4M in remediation, legal fees, and lost business justifies significant security infrastructure investment.

Competitive disadvantages from outdated technology affect market position measurably. If competitors deliver features faster because they have modern CI/CD pipelines while you manually deploy, this impacts revenue. Quantify the business value of capabilities your infrastructure prevents implementing.

How Should You Prioritize Infrastructure Investments?

Risk impact matrices that plot probability and business consequence help allocate limited IT infrastructure budget to highest value initiatives delivering maximum return. Investment prioritization prevents spreading resources too thin across too many projects.

Plot each potential infrastructure project on a grid with axes for implementation difficulty and business impact. High impact, low difficulty projects become quick wins you can fund first. High impact, high difficulty projects require careful planning and potentially phased funding.

Prioritization framework steps:

- Assess business impact: Revenue effect, risk reduction, efficiency gain, strategic enablement

- Evaluate implementation complexity: Cost, timeline, resource requirements, technical risk

- Calculate ROI or risk reduction value: Quantify benefits against investment

- Categorize projects: Quick wins, strategic initiatives, necessary maintenance, nice to have

- Allocate budget: Fund quick wins first, reserve majority for strategic projects

Business case building for top priority initiatives requires specific financial projections. Calculate three year TCO for infrastructure investments including initial costs, ongoing expenses, and expected benefits. Show payback period and cumulative ROI to justify expenditure.

Balance quick wins delivering immediate value against strategic projects enabling long term objectives. Quick wins build momentum and demonstrate IT’s value, making approval of larger strategic investments easier. Strategic projects position the organization for future success even if payback extends beyond one year.

What Documentation Do Finance Teams Need for Approval?

Detailed Total Cost of Ownership (TCO) analysis, competitive vendor quotes, ROI projections with assumptions, and risk assessments satisfy financial approval scrutiny that IT infrastructure budget requests face. IT budget documentation must meet finance team standards, not just technical justification.

Finance teams evaluate infrastructure requests like any capital investment. They need hard numbers, clear assumptions, comparison of alternatives, and understanding of ongoing costs. Vague efficiency claims don’t satisfy CFO requirements for proof.

Required budget documentation:

- Complete TCO breakdown showing all costs over 3-5 years

- At least three vendor quotes for major purchases

- ROI calculation with clearly stated assumptions

- Comparison with status quo and alternative approaches

- Implementation timeline with resource requirements

- Risk assessment if investment is not approved

TCO analysis must include all cost components finance teams scrutinize. Initial hardware or software costs are obvious, but implementation services, training, ongoing support, and infrastructure changes add significantly. Underestimating TCO damages credibility and creates budget shortfalls mid-project.

Vendor quotes provide pricing validation and negotiating leverage. Obtain proposals from multiple vendors for significant purchases. Even if you prefer one vendor, competitive quotes prove you’ve done market research and secured fair pricing. Finance appreciates this diligence.

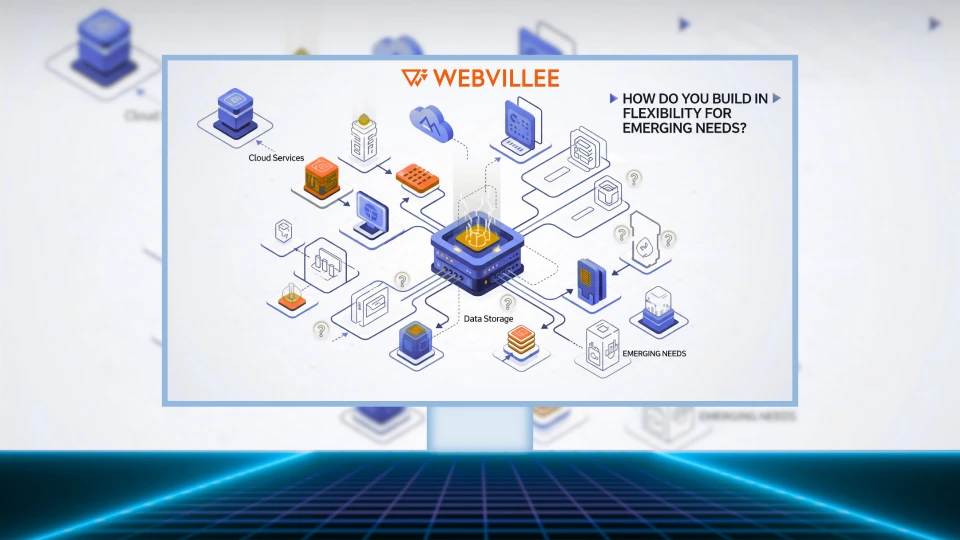

How Do You Build in Flexibility for Emerging Needs?

Reserve 15 to 20% contingency budget for unplanned requirements and opportunities that inevitably arise during the fiscal year. Budget flexibility planning acknowledges that perfect prediction is impossible and allows response to changing conditions.

Rigid budgets that allocate every dollar to specific projects leave no capacity for emerging needs. When security vulnerabilities require urgent patching, business units request new capabilities, or strategic acquisitions need integration, you need available budget.

Flexibility mechanisms:

- Contingency budget line item for unplanned but necessary expenses

- Quarterly budget reviews allowing reallocation between categories

- Pre-approved processes for emergency spending within limits

- Strategic reserve for competitive opportunities requiring fast action

Contingency budget should be explicitly included in your request rather than hidden padding. Finance teams respect honest acknowledgment that needs will evolve. Frame contingency as risk management allowing response to both threats and opportunities.

Mid-year adjustments let you reallocate between projects based on actual progress and changing priorities. Some initiatives complete under budget or get delayed, freeing funds for other needs. Formal quarterly reviews with finance partners allow these adjustments within approved total spending.

What Multi-Year Infrastructure Investments Should You Plan?

Major infrastructure initiatives like data center modernization, cloud migration, or enterprise system replacements require multi-year budget commitments with phased funding across fiscal years. Multi-year IT planning provides realistic timelines and prevents trying to compress large projects into single year budgets.

Capital planning for infrastructure should align with asset lifecycle. Server refresh cycles, network equipment replacement, and software platform upgrades follow predictable schedules. Planning these multi-year helps spread costs and prevents surprise large expenditures.

Multi-year planning components:

- Three to five year infrastructure roadmap showing major initiatives

- Hardware refresh schedule based on typical 4-5 year lifecycles

- Platform modernization timelines for aging enterprise systems

- Phased cloud migration showing workload transition schedules

- Annual budget estimates for each roadmap component

Infrastructure roadmap communicates your long term vision to executives. Show how current year requests fit into multi-year transformation journey. This context helps leaders understand you’re executing a strategy, not making ad hoc requests.

Phased funding for large projects spreads budget impact across years while allowing progress. Year one might cover planning and pilot, year two handles primary implementation, year three completes rollout. This approach makes expensive initiatives more palatable than requesting full funding upfront.

How Do You Align IT Budget with Business Strategy?

Demonstrating how infrastructure investments directly enable business strategy increases executive buy-in and approval likelihood significantly. IT business alignment transforms infrastructure from cost center perception to strategic enabler positioning.

Business strategy documents like annual plans, board presentations, and executive priorities provide your alignment framework. Review these materials identifying where infrastructure capabilities enable or constrain stated objectives. Frame your budget requests as enablers of these priorities.

Strategic alignment approaches:

- Map infrastructure projects to specific business objectives from strategic plans

- Use business language describing outcomes rather than technical specifications

- Show how investments support revenue growth, market expansion, or efficiency targets

- Demonstrate competitive necessity when competitors have superior capabilities

- Connect infrastructure to customer experience improvements executives prioritize

Executive communication should emphasize business outcomes infrastructure enables. Rather than requesting “application modernization,” request “customer portal capabilities supporting our digital customer experience strategy.” The technology is means to business end.

Strategic initiatives often have executive sponsors you can engage as advocates. When your infrastructure request enables their strategic objective, they become allies in budget approval process. Build these relationships throughout the year, not just during budget season.

Executing Your Budget Preparation Strategy

Successful IT infrastructure budget preparation requires starting early, building data driven cases, and maintaining clear business alignment throughout the process. This infrastructure budget strategy delivers approval rates significantly higher than last minute technical requests lacking business context.

The seven preparation strategies covered here provide a systematic approach to budget cycle preparation. Begin 6 to 9 months before fiscal year with infrastructure audits, continue through gap analysis and prioritization, and conclude with documentation finance teams need for approval.

Organizations implementing these preparation strategies report 40 to 60% higher budget approval rates and faster authorization processes. Investment in thorough preparation pays dividends in securing resources your infrastructure requires.

Ready to develop your 2026 infrastructure budget strategy and build compelling business cases? Get in touch with Webvillee to explore assessment services and budget planning support tailored to your infrastructure requirements.