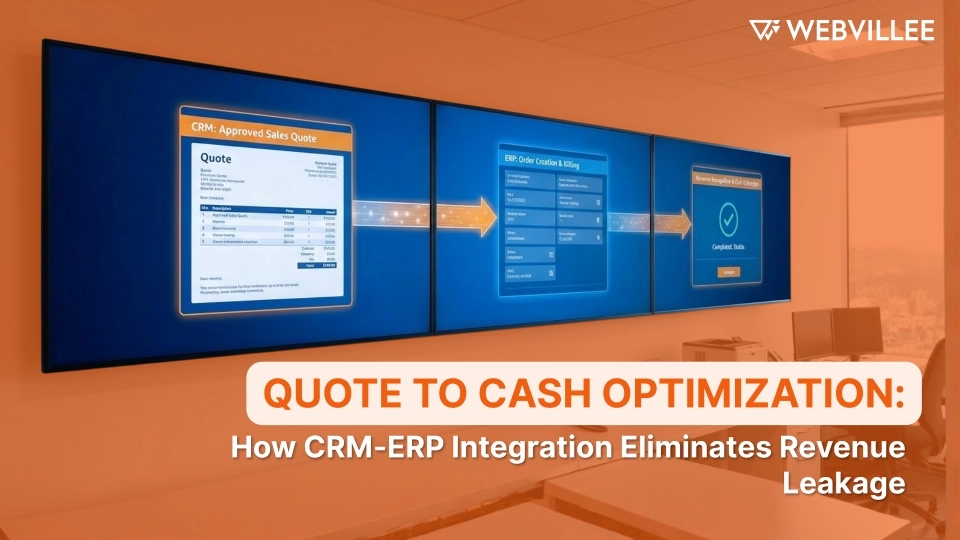

Quote to Cash Optimization: How CRM-ERP Integration Eliminates Revenue Leakage

CRM ERP integration quote to cash optimization connects sales and finance systems to eliminate revenue leakage caused by manual errors, disconnected data, and billing delays that quietly erode margins between the initial quote and final cash collection.

Why Revenue Leaks Between the Quote and CRM ERP Integration Quote to Cash

Revenue leaks between quote and cash because CRM ERP integration quote to cash processes face hidden complexity in enterprise sales cycles where strong demand still results in missed revenue through disconnected systems.

Enterprise sales cycles involve multiple stakeholders, approval layers, and handoffs between teams. Each touchpoint creates opportunities for errors, delays, and miscommunication.

Why strong demand still results in missed revenue becomes clear when examining what happens after the sale. Sales teams close deals, but revenue disappears during execution.

How Disconnected Systems Quietly Erode Margins

Research shows that 42% of companies experience revenue leakage costing between 3% and 7% of their top line revenue annually. This happens invisibly as small inefficiencies compound across deal volume.

Disconnected systems force manual data transfers. Sales records live in CRM. Finance works in ERP. The gaps between create errors that leak revenue without triggering alarms until margins suffer noticeably.

What Is Quote to Cash and Why It Matters More Than Ever

Quote to cash is the complete business process from generating customer quotes through collecting final payment that connects sales, finance, and operations to determine revenue predictability and cash flow health.

In plain language, quote to cash covers everything that happens between your sales team creating a proposal and your finance team receiving payment in the bank account.

How Quote to Cash Connects Sales, Finance, and Operations

The quote to cash lifecycle spans these key activities:

- Sales configures products and services to meet customer needs

- Pricing teams apply discounts, bundles, and contract terms

- Finance processes orders and generates invoices

- Operations fulfills commitments and tracks delivery

- Accounting recognizes revenue according to compliance standards

Why Quote to Cash Performance Directly Impacts Revenue Predictability

Organizations with optimized quote to cash processes achieve 40% faster deal cycles and 25% faster revenue recognition. This speed directly improves cash flow and forecast accuracy.

Conversely, over 60% of companies with disjointed quote to cash processes report delayed revenue recognition and poor forecasting accuracy, creating uncertainty that undermines business planning.

Where Revenue Leakage Typically Happens in Quote to Cash

Revenue leakage happens most frequently through manual quoting errors with inconsistent pricing, contract mismatches between sales and finance, plus billing delays and disputes that slow collections.

Manual quoting errors and inconsistent pricing occur when sales teams lack access to current price lists, approved discount structures, and configuration rules.

Contract Mismatches Between Sales and Finance

Sales commits to terms that finance systems cannot execute. Discounts promised during negotiation do not appear in billing systems. Service levels documented in contracts lack corresponding order details.

These mismatches create customer disputes, delayed payments, and revenue recognition problems that finance teams spend weeks untangling.

Billing Delays, Disputes, and Slow Collections

Research shows 35% of manual quotes contain pricing errors that slow deals. When invoices do not match purchase orders or contracts, customers rightfully refuse payment until discrepancies resolve.

Collections teams chase payments for billing mistakes instead of focusing on actual late payers. This extends days sales outstanding and strains working capital.

Why Disconnected CRM and ERP Systems Create Structural Risk

Disconnected CRM and ERP systems create structural risk because sales works in CRM while finance lives in ERP, forcing data handoffs through spreadsheets and emails that multiply errors as deal volume grows.

Sales teams manage opportunities, quotes, and customer relationships in CRM platforms. They close deals based on information visible in their system.

Data Handoffs That Rely on Spreadsheets and Emails

After sales closes a deal, someone must manually transfer information to ERP for order processing. This typically involves:

- Copying customer details from CRM to ERP

- Re entering product configurations and pricing

- Attaching contract terms in email threads

- Following up to confirm finance received everything

- Correcting errors discovered during billing

How System Gaps Multiply Errors as Deal Volume Grows

One manual transfer per deal seems manageable. Fifty deals per month creates fifty opportunities for mistakes. Data shows disconnected systems cause 40% of order to cash delays.

As organizations scale, manual processes break down completely. Sales velocity that should accelerate revenue instead creates chaos that erodes margins through inefficiency.

How CRM ERP Integration Transforms the Quote to Cash Process

CRM ERP integration quote to cash transformation creates a single source of truth from quote to invoice through real time data flow between sales and finance teams that eliminates rework, delays, and manual reconciliation.

Integration connects sales and finance systems so information flows automatically. When sales closes a deal in CRM, order details appear immediately in ERP without human intervention.

Real Time Data Flow Between Sales and Finance Teams

Real time integration means:

- Customer information syncs instantly across systems

- Product configurations transfer automatically

- Pricing and discounts match exactly between quote and invoice

- Contract terms flow directly to billing workflows

- Both teams see the same information simultaneously

Eliminating Rework, Delays, and Manual Reconciliation

Organizations implementing CRM & ERP integration report up to 60% fewer errors compared to manual processes. This elimination of rework accelerates revenue recognition and improves customer satisfaction.

Finance teams stop chasing sales for missing information. Sales stops fielding questions about order status. Both focus on higher value activities instead of reconciling disconnected data.

Key Stages of Quote to Cash Improved Through Integration

Integration improves configure price quote accuracy and approval workflows, enables seamless contract to order conversion, plus automated invoicing and revenue recognition alignment across the entire quote to cash lifecycle.

Configure price quote accuracy improves when sales accesses real time product catalogs, current pricing rules, and approved discount structures directly from integrated ERP.

Seamless Contract to Order Conversion

Once customers sign contracts, integrated systems automatically convert agreements into executable orders. Customer details, product specifications, pricing, and terms flow from signed contract to active order without re entry.

This seamless conversion prevents the manual translation errors that cause billing disputes and delayed revenue recognition.

Automated Invoicing and Revenue Recognition Alignment

Billing systems automatically generate invoices based on order details synchronized from CRM. Revenue recognition follows accounting standards because finance systems receive accurate contract terms and delivery milestones from the start.

Organizations see measurable ROI within 30 to 90 days of implementing quote to cash automation through faster invoicing and compliant revenue recognition.

How CRM ERP Integration Reduces Revenue Leakage

Integration reduces revenue leakage by preventing pricing and discount inconsistencies, reducing order fallout and billing disputes, plus accelerating cash collection cycles through accurate automated processes.

Preventing pricing and discount inconsistencies happens when both sales and finance reference identical pricing databases. Sales cannot accidentally offer outdated prices or unauthorized discounts.

Reducing Order Fallout and Billing Disputes

Order fallout occurs when agreements cannot execute because sales committed to terms that operations cannot deliver. Integration validates configurations and pricing during quoting, preventing impossible commitments.

Billing disputes drop dramatically when invoices match signed contracts exactly. Customers receive what they agreed to purchase at the prices they negotiated.

Accelerating Cash Collection Cycles

Accurate invoices get paid faster. Customers do not dispute charges that match expectations. Collections teams focus on actual late payments instead of resolving billing errors.

Organizations report reducing days sales outstanding by 15 to 25% through integration that eliminates the friction causing payment delays.

The Business Impact of Optimized Quote to Cash Operations

Optimized quote to cash operations deliver faster deal cycles without added risk, improved forecasting and revenue visibility, plus higher margins through disciplined execution across integrated systems.

Faster deal cycles happen when sales generates accurate quotes instantly using real time data. Approval workflows route automatically based on deal size and discount levels.

Improved Forecasting and Revenue Visibility

Finance teams see the complete pipeline from quote through cash in real time. Revenue forecasts reflect actual deal status instead of stale snapshots transferred manually.

Leadership makes decisions based on current information rather than outdated reports assembled from disconnected systems.

Higher Margins Through Disciplined Execution

Disciplined execution means pricing rules get enforced automatically. Discounts require appropriate approvals. Contract terms match operational capabilities.

This discipline prevents margin erosion from unauthorized discounts, unrealistic commitments, and billing errors that force revenue write offs.

Common Challenges Enterprises Face When Optimizing Quote to Cash

Enterprises face challenges from over customizing systems instead of simplifying processes, misalignment between sales and finance incentives, and underestimating data quality and change management needs.

Over customization creates complexity that defeats automation benefits. Organizations build elaborate workflows trying to preserve every existing exception instead of standardizing processes.

Misalignment Between Sales and Finance Incentives

Sales incentives reward closing deals quickly. Finance incentives reward accuracy and compliance. These competing priorities create conflict when systems force collaboration.

Successful optimization requires leadership to align incentives so both teams benefit from accurate, efficient quote to cash execution.

Underestimating Data Quality and Change Management Needs

Integration exposes data quality problems hidden in disconnected systems. Duplicate customer records, inconsistent product names, and outdated pricing must be cleaned before automation delivers value.

Change management requires more effort than technology implementation. Teams need training, process documentation, and ongoing support to adopt new workflows successfully.

Best Practices for Successful CRM ERP Integration

Successful integration requires designing quote to cash around real workflows, standardizing pricing terms and approval rules, plus building governance without slowing sales velocity through balanced controls.

Designing around real workflows means observing how teams actually work instead of imposing theoretical ideal processes. Automation that fights human nature fails regardless of technology quality.

Standardizing Pricing, Terms, and Approval Rules

Standard pricing structures simplify automation. Tiered discount levels with clear approval requirements balance sales flexibility with margin protection.

Contract templates with standard terms accelerate legal review. Custom terms that require negotiation follow exception workflows instead of blocking standard deals.

Building Governance Without Slowing Sales Velocity

Governance rules should enable speed, not prevent it. Automated approvals route instantly to appropriate stakeholders based on deal characteristics.

Sales should not wait days for routine approvals. Finance should not discover unauthorized commitments after deals close. Balanced governance prevents both problems.

Measuring Success in Quote to Cash Optimization

Measuring success requires tracking revenue leakage indicators, cycle time and cash flow metrics that matter, plus using insights to continuously refine the process through data driven improvement.

Revenue leakage indicators include:

- Percentage of invoices disputed by customers

- Write offs from unbillable contract terms

- Discounts exceeding approved thresholds

- Revenue recognition delays from missing information

- Payment delays caused by billing errors

Cycle Time and Cash Flow Metrics That Matter

Track quote to order time, order to invoice time, and invoice to cash time separately. This reveals where delays concentrate so improvement efforts focus appropriately.

Cash flow metrics like days sales outstanding directly measure the financial impact of quote to cash efficiency on working capital.

Using Insights to Continuously Refine the Process

Integration provides data that manual processes cannot capture. Analyze patterns to identify which products cause configuration errors, which customers dispute invoices most frequently, and which sales reps generate the cleanest quotes.

Continuous improvement based on this intelligence makes processes stronger over time instead of static after initial implementation.

How to Get Started With Quote to Cash Optimization

Getting started requires identifying the highest leakage points first, aligning stakeholders across sales finance and IT, then creating a phased roadmap instead of big bang rollout.

Identify where revenue leaks most severely. Map the current quote to cash process to find bottlenecks, error patterns, and manual handoffs consuming the most time.

Aligning Stakeholders Across Sales, Finance, and IT

All three groups must agree on objectives and priorities. Sales needs speed. Finance needs accuracy. IT needs maintainable systems.

Successful projects balance these requirements through collaborative design that meets everyone’s core needs without over optimizing for any single stakeholder.

Creating a Phased Roadmap Instead of Big Bang Rollout

Start with high value, lower complexity integrations. Automate quote to order conversion before tackling complex revenue recognition scenarios.

Each phase delivers measurable benefits that fund subsequent improvements. Quick wins build momentum and prove value to skeptics.

Why Quote to Cash Optimization Is a Revenue Strategy, Not an IT Project

Quote to cash optimization is a revenue strategy using technology as the enabler of disciplined growth that turns operational efficiency into competitive advantage while building scalable foundation for predictable revenue growth.

Technology enables change but does not create value alone. The strategy behind how organizations use integration to improve execution determines business impact.

Turning Operational Efficiency Into Competitive Advantage

Organizations that quote faster, execute accurately, and collect efficiently win deals competitors lose to operational friction. Customers choose vendors who make buying easy.

Superior quote to cash execution becomes a differentiator in competitive markets where product features and pricing reach parity.

Building a Scalable Foundation for Predictable Revenue Growth

Manual processes that work at small scale break under growth pressure. Integrated systems scale smoothly as deal volume increases without proportional headcount growth.

This scalability creates the operational leverage that enables profitable growth instead of revenue increases that disappear into administrative overhead.

Key Takeaways for Quote to Cash Optimization

CRM ERP integration quote to cash optimization eliminates revenue leakage by connecting disconnected systems where sales works in CRM while finance operates in ERP through automated data flow.

Revenue leakage costs organizations 3 to 7% of top line revenue through manual quoting errors, contract mismatches, billing disputes, and collection delays that integration prevents.

Successful integration improves configure price quote accuracy, enables seamless contract to order conversion, and automates invoicing with revenue recognition alignment.

Organizations achieve 40% faster deal cycles, 25% faster revenue recognition, and up to 60% fewer errors within 30 to 90 days of implementing quote to cash automation.

Best practices include designing around real workflows, standardizing pricing and approval rules, building governance that enables velocity, and using data insights for continuous improvement.

Contact Webvillee to explore how CRM ERP integration can eliminate revenue leakage in your quote to cash processes while building scalable foundation for predictable revenue growth.